The Nuclear Power Market Report 2025 highlights how inspection robots, uranium mining, and advanced reactors, are reshaping power production and sustainability. With rising energy demands, the report explores nuclear power’s role in energy security, reducing carbon emissions, and driving innovation while offering key insights for investors, policymakers, and industry stakeholders.

This report was last updated in January 2025.

Executive Summary: Nuclear Power Market Report 2025

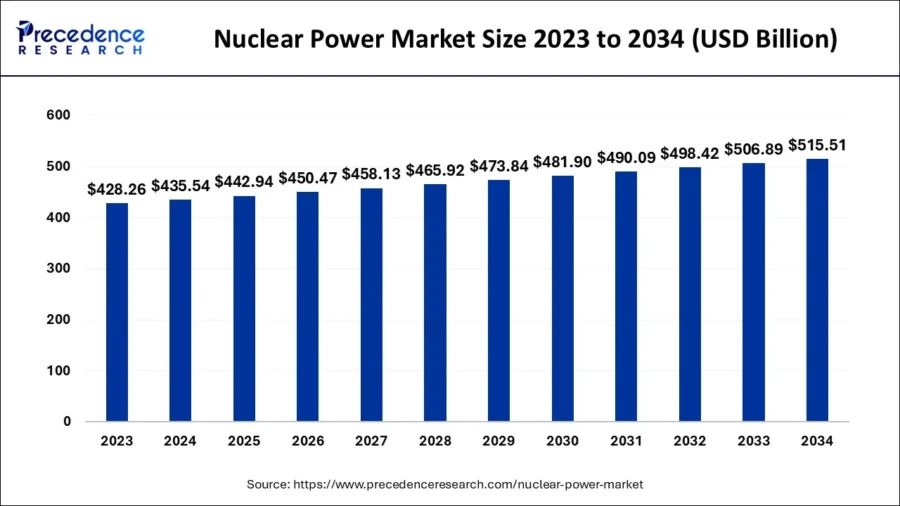

- Industry Growth Overview: The global nuclear power market demand is anticipated to reach USD 442.94 giga-watt in 2025 to around USD 515.51 giga-watt by 2034. On a micro level, the nuclear power industry experienced a declining annual growth rate of 3.19%.

- Manpower & Employment Growth: The sector employs over 1 million individuals, with an increase of 34K+ new jobs created in the past year.

- Patents & Grants: The nuclear power industry holds more than 115K patents and has received over 850 grants.

- Global Footprint: Major country hubs include the USA, India, the UK, China, and France, while key city hubs are Mumbai, London, New York City, Moscow, and Toronto.

- Investment Landscape: The average funding round exceeds USD 111 million, with more than 1480 funding rounds closed.

- Top Investors: Key investors like Doe Loan Programs Office, Atomredmetzoloto, Banca Patrimoni Sella & C, and more collectively contributed over USD 7.305 billion to the nuclear power market.

- Startup Ecosystem: Five innovative startups Last Energy (MWe micro modular nuclear power plants), SYSCADE (nuclear waste management), Fluid Wire Robotics (force-control robotic arms), Stellaria (molten salt reactors), and Scintam Engineering (maintenance & decommissioning) showcase the sector’s global reach and entrepreneurial spirit.

Methodology: How We Created This Nuclear Power Market Report

This report is based on proprietary data from our AI-powered StartUs Insights Discovery Platform, which tracks 25 million companies and 20 000 technologies and trends globally, including detailed insights on approximately 5 million startups, scaleups, and tech companies. Leveraging this extensive database, we provide actionable insights on emerging technologies and market trends.

For this report, we focused on the evolution of nuclear power over the past 5 years, utilizing our platform’s trend intelligence feature. Key data points analyzed include:

- Total Companies working on the trend

- News Coverage and Annual Growth

- Market Maturity and Patents

- Global Search Volume & Growth

- Funding Activity and Top Countries

- Subtrends within nuclear power

Our data is refreshed regularly, enabling trend comparisons for deeper insights into their relative impact and importance.

Additionally, we reviewed external resources to supplement our findings with broader market data and predictions, ensuring a reliable and comprehensive overview of the nuclear power industry.

What Data is Used to Create This Nuclear Power Report?

Based on the data provided by our Discovery Platform, we observe that the nuclear power industry ranks among the top 5% in the following categories relative to all 20K topics in our database.

These categories provide a comprehensive overview of the industry’s key metrics and inform the short-term future direction of the industry.

- News Coverage & Publications: The nuclear power industry received over 560 publications in the last year.

- Funding Rounds: Our database shows more than 1480 funding rounds.

- Manpower: The industry employs over 1 million workers, with an addition of more than 34K new employees in the last year.

- Patents: The nuclear power sector has over 115K patents filed.

- Grants: More than 850 grants have been awarded in the nuclear power sector.

- Yearly Global Search Growth: The annual growth in worldwide searches reached 37.60% which indicates increased public interest and engagement in nuclear power developments.

Explore the Data-driven Nuclear Power Market Report for 2025

As per the Precedence Research report, the global nuclear power market demand is anticipated to reach USD 442.94 giga-watt in 2025 to around USD 515.51 giga-watt by 2034.

According to Mordor Intelligence, the nuclear power market size is estimated at 398.24 gigawatts in 2025 and is expected to reach 439.69 gigawatts by 2030, at a CAGR of 2% during the forecast period 2025-2030.

The nuclear power industry outlook 2025 uses data from the Discovery Platform and encapsulates the key metrics that underline the sector’s dynamic growth and innovation.

Our database contains over 630 startups and more than 4640 companies which showcases major activity within the nuclear power sector. The industry experienced a slight contraction last year, with a growth rate of -3.19%.

Credit: Precedence Research

Additionally, the global workforce in the nuclear power sector exceeds 1 million professionals. Notably, employee growth in the past year reached 34K+ which suggests a demand for talent.

The top five country hubs include the USA, India, the UK, China, and France which demonstrate diverse international engagement.

Similarly, major city hubs, including Mumbai, London, New York City, Moscow, and Toronto, serve as critical centers for activity and collaboration within the nuclear power industry.

A Snapshot of the Global Nuclear Power Industry

The nuclear power industry experienced an annual growth rate of -3.19% which indicates challenges in market expansion. Despite this, the sector remains active, with over 630 startups contributing to innovation and development.

Among these startups, more than 100 are in the early stages and over 290 companies have undergone mergers and acquisitions. The sector has over 115K patents supported by approximately 12K+ applicants striving to secure their inventions.

However, the yearly patent growth rate stands at -2.29% which indicates a potential slowdown in new patent filings. China leads as the top issuer of patents, with over 27K, followed by the USA with more than 19K patents.

Explore the Funding Landscape of the Nuclear Power Industry

The average investment value is over USD 111 million per funding round. More than 1K investors actively participate in this space.

The nuclear energy industry has completed over 1480 funding rounds which showcase sustained interest and involvement from various stakeholders.

Additionally, these funding efforts have reached over 410 companies which demonstrates the widespread distribution of financial resources across the nuclear power sector.

Who is Investing in the Nuclear Power Market?

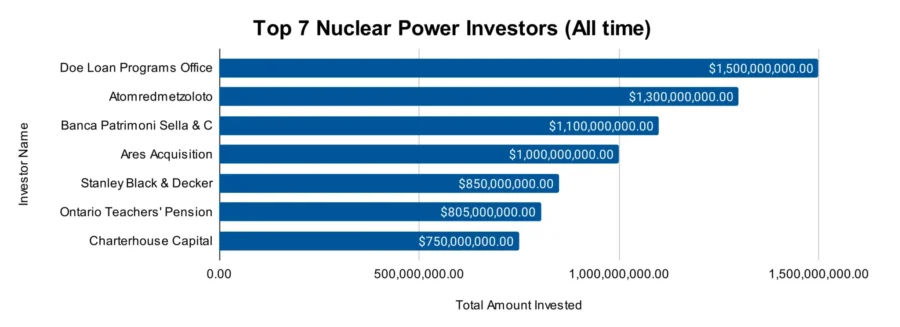

The combined investment value of the top investors in the nuclear power sector exceeds USD 7.305 billion.

- Doe Loan Programs Office has invested USD 1.5 billion in at least 1 company. The DOE approved a USD 996 million loan for ioneer’s Rhyolite Ridge lithium project in Nevada.

- Atomredmetzoloto has contributed USD 1.3 billion to at least 1 company. ARMZ partnered with Mongolia’s Monatom to develop the Dornod uranium resource, holding a 49% stake.

- Banca Patrimoni Sella & C has allocated USD 1.1 billion to at least 1 company. Banca Patrimoni Sella extended its partnership with CNP Vita Assicura until 2034.

- Ares Acquisition invested USD 1 billion in at least 1 company. Ares Management agreed to acquire GLP Capital Partners’ international operations, excluding China, for USD 3.7 billion.

- Stanley Black & Decker has provided USD 850 million to at least 1 company. Stanley Black & Decker secured a USD 1.25 billion 364-day revolving credit loan from Citibank.

- Ontario Teachers’ Pension Plan has invested USD 805 million in at least 1 company. OTPP, in partnership with Nordic Capital, jointly acquired Max Matthiessen which is a leading Nordic financial advisor.

- Charterhouse Capital Partners has contributed USD 750 million to at least 1 company. Charterhouse also agreed to acquire Metrodora which is a leading Spanish educational group, from Magnum Capital.

Further, the global investment in nuclear power is expected to rise from approximately USD 65 billion per year to USD 70 billion per year by 2030.

SMRs also could provide 80 GW by 2040 if costs become competitive, according to the IEA.

Tech giants invest in nuclear energy, with Constellation Energy signing a USD 40 million federal contract and a major deal with Microsoft.

Top Nuclear Power Innovations & Trends

Explore the emerging nuclear power trends driving the industry forward, along with the firmographic insights:

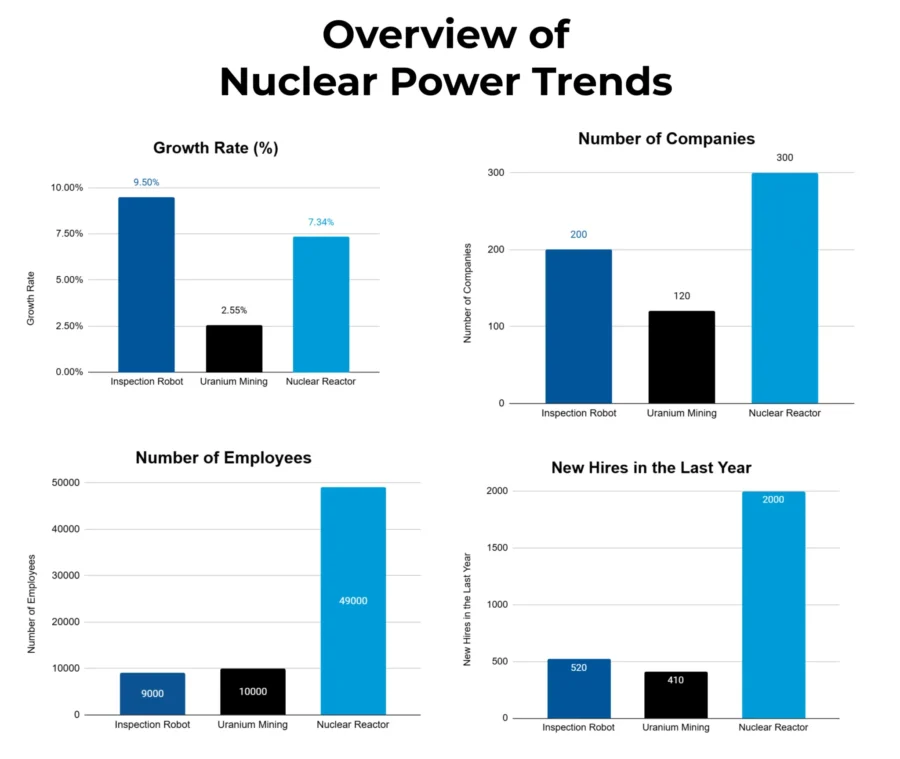

- Inspection Robot trend shows major growth, with over 200 total companies. This trend employs more than 9K individuals which reflects the nuclear power sector’s expanding workforce. In the last year alone, the industry added over 520 new employees. The annual growth rate stands at 9.50% which showcases increasing interest and investment in robotic solutions for maintenance, safety checks, and inspections in nuclear power plants.

- Uranium Mining trend includes more than 120 total companies that contribute to the global power supply. This segment employs around 10K+ workers, with an addition of over 410 new employees last year. The annual growth rate for uranium mining is 2.55%, which highlights the nuclear power industry’s need for reliable fuel sources.

- Nuclear Reactor trend, with over 300 companies and 49K professionals, saw a growth of 2K+ jobs in the past year. It has an annual growth rate of 7.34% which reflects the increasing importance of nuclear power. Besides future energy demands.

5 Top Examples from 630+ Innovative Nuclear Power Industry Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

Last Energy develops MWe Micro Modular Nuclear Power Plants

Last Energy is a US-based startup that is improving nuclear power with its modular PWR-20 technology. This 20 MWe reactor system, built on proven pressurized water reactor designs, is factory-fabricated for quick and easy deployment.

The PWR-20 units are shipped on standard trucks to rapidly set up at customer sites and to minimize construction and commissioning time.

With a compact 0.3-acre footprint and air-cooled design, these modular plants are versatile to install in diverse environments for addressing capacity constraints and increasing grid resilience.

Last Energy also offers an energy-as-a-service model to provide industrial facilities and grid operators with emission-free baseload power while handling design, operations, and more.

SYSCADE specializes in Nuclear Waste Management

Belgian startup SYSCADE develops solutions for nuclear waste characterization and offers products that increase the efficiency and safety of waste management.

Its SYSCADE mobile unit combines X-ray inspection and gamma characterization to assess radioactive waste automatically. This mobile unit product provides detailed data on drum contents, isotope identification, and activity levels.

It also uses a conveyor with a turntable for optimal throughput, and its dedicated software analyzes measurements to pinpoint radioactive sources and contaminants.

Further, the SYSCAN electric vehicle is created for ground contamination monitoring, quick identification of hot spots, and for measuring low-level contamination.

Moreover, the gamma station offers fully automated gamma characterization of nuclear waste drums and uses high-resolution detectors for precise activity measurement and quick data analysis.

Fluid Wire Robotics offers Force-Controllable Robotic Arms

Fluid Wire Robotics is an Italian startup that develops robotic arms for challenging environments in the nuclear energy sector.

Its Fluid Wire technology enables fully electric, force-controllable manipulator arms that operate efficiently in harsh conditions.

The technology features electric motors and sensors housed in a sealed remote actuation unit, with power transmitted to the joints through a transmission system, known as Fluid Wires.

This design eliminates additional structural complexity while offering reliable operation in water, high-temperature, pressurized environments, vacuum, and explosive atmospheres.

Further, the robotic arms are lightweight, modular, and standardized which makes them ideal for handling radioactive materials, performing decommissioning tasks, and inspecting objects under radioactive water.

Stellaria builds an Advanced Molten Salt Reactor

Stellaria is a French startup that develops the Stellarium which is a molten salt reactor that provides sustainable, low-cost energy solutions.

The reactor operates using molten salts as fuel and is capable of renewing its fuel during operation and incinerating high-level waste. This reactor also features four containment barriers and an underground installation.

Stellarium is flexible to produce electricity, e-fuels, or high-temperature steam based on industrial needs.

Moreover, the startup’s technology supports deep decarbonization and sustainable processes, for petrochemical plants and data centers to achieve autonomy, safety, and competitiveness while reducing CO2 emissions.

Scintam Engineering delivers Maintenance & Decommissioning Processes

UK based startup Scintam Engineering develops the FastEDR technology which is a fastener removal solution for hazardous and hard-to-reach environments.

Its electrical-discharge-based machining process allows the rapid removal of metallic fasteners in a controlled and enclosed environment.

The technology reduces operator exposure to radiation and hazardous materials by integrating optional robotic automation. This makes the FastEDR system a safer choice for maintenance in nuclear power plants and other high-risk industries.

Further, this portable technology minimizes downtime, speeds up maintenance, and reduces the risk of component damage.

Gain Comprehensive Insights into Nuclear Power Industry Trends, Startups, or Technologies

In 2025, the nuclear power market will emphasize innovation, safety, and sustainability. Key trends such as inspection robots, uranium mining, and nuclear reactors will reshape operations and improve safety protocols. As these trends develop, the industry will prioritize efficiency and regulatory compliance while addressing public concerns about safety and environmental impacts.

Get in touch to explore all 630+ startups and scaleups, as well as all industry trends impacting nuclear power industry companies.